medical revenue service address

Formally a string is a finite ordered sequence of characters such as letters digits or spaces. Or payments to the above address.

Exploring The Fundamentals Of Medical Billing And Coding

Qualifying rural originating site such as a clinicphysician office or may be a specified medical facility.

. Postal Service to mail an item to a PO. Equipment Address 3325 Mount Prospect Road Franklin Park IL 60131. Check this box if the organization changed its address and hasnt reported the change on its most recently filed Form 990 990-EZ 990-N or 8822-B Change of Address or Responsible PartyBusiness or in correspondence to the IRS.

Clicking a currency pair brings up a list exchangers with the best rates while clicking a specific exchangers name opens a corresponding website. NW IR-6526 Washington DC 20224. The Internal Revenue Service IRS is the revenue service for the United States federal government which is responsible for collecting US.

Box 7604 Ben Franklin Station Washington DC 20044. A person authorized to act on behalf of a payment card organization may submit a written request for a QPCA determination to the following address. Powerbox announces 105 models of DCDC converters featuring 2xMOPP medical approvals.

Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. The approving official annotates Employee Deceased on the employee signature line signs the voucher and forwards for payment to at the following address. Centurion Service Group is a one-stop-shop your medical equipment purchasing needs.

See the Instructions for. Internal Revenue Service Tax Forms and Publications Division 1111 Constitution Ave. Or for leave taken after March 31 2021 and before October 1 2021 is seeking or awaiting the results.

Buy surplus certified pre-owned and new medical equipment. Free press release distribution service from Pressbox as well as providing professional copywriting services to targeted audiences globally. Box 9002 Beckley WV 25802-9002 Efax 855-787-4375 email CFO Travel Vouchers.

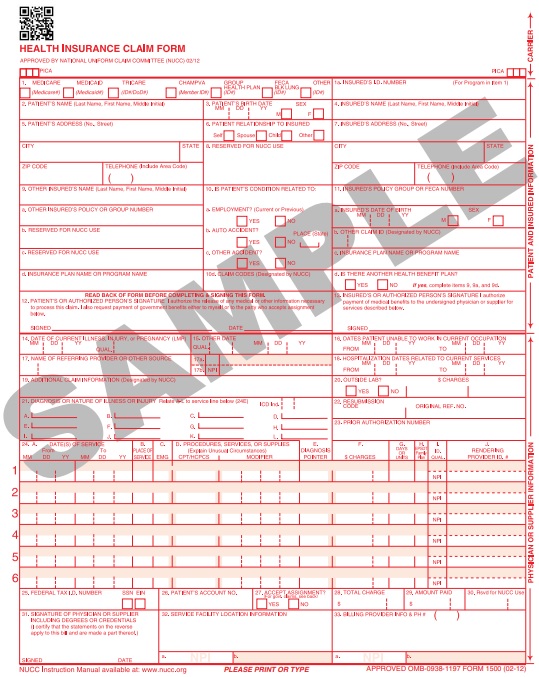

Modifier GT is no longer used for Medicare on professional claims when reported with place of service 02. Internal Revenue Service PO. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

To claim transportation and travel expenses all of the following conditions must be met. This revenue includes program service revenue reported on Part VIII line 2 column A and. Community Health Needs Assessment.

This procedure modifies and supersedes Rev. The distant site provider will bill their service with place of service 02. Dont send tax questions tax returns or payments to the above address.

Substantially equivalent medical services were not. The public hearing is being held in the IRS Auditorium Internal Revenue Service Building 1111 Constitution Avenue NW Washington DC 20224. Travel expenses at least 80 km the cost of the travel expenses including accommodations meals and parking when a person needs to travel at least 80 kilometres one way from their home to get medical services.

A payment card organization requesting a. Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments as we revise our tax forms instructions and publications. On July 17 2015 the Department of the Treasury Treasury and the Internal Revenue Service IRS published a notice of proposed rulemaking REG13552414 in the Federal Register 137 FR 42439 under section 83 of the Code eliminating the requirement that a copy of a section 83b election be submitted with the taxpayers income tax.

Or you can write to. Account on March 15 2020 or had a payroll service provider administer its payroll service and certain conditions are met see Q3-8 and meets all other eligibility. A revenue reduction of greater than 10 will be required to be eligible for the wage subsidy for periods 18 to 20 from July 4 2021 to September 25 2021 see Q5-01.

Internal Revenue Service 1601 Market Street 20th Floor ATTN. In addition to the general requirements for tax exemption under Section 501c3 and Revenue Ruling 69-545 PDF hospital organizations must meet the requirements imposed by Section 501r on a facility-by-facility basis in order to be treated as an organization described in Section 501c3. Were the Driver and Vehicle Licensing Agency DVLA holding more than 50 million driver records and more than 40 million vehicle records.

We collect over 7 billion a year in Vehicle Excise. Medical and health care payments and crop insurance proceeds. We welcome your comments about this publication and suggestions for future editions.

Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms instructions and publications. These additional requirements are. Although we cant respond individually to each comment received we do appreciate your feedback and will consider your comments and suggestions as we revise our tax forms instructions and publications.

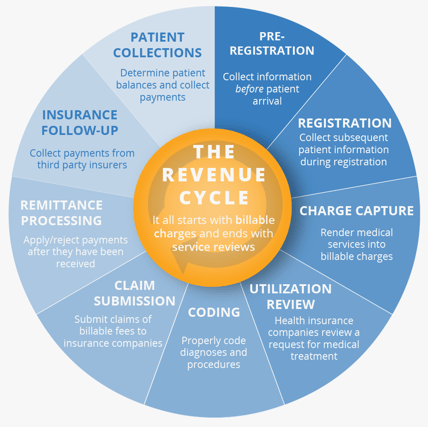

Medical billing is a payment practice within the United States health systemThe process involves a healthcare provider obtaining insurance information from a patient and filing following up on and appealing claims with health insurance companies in order to receive payment for services rendered such as testing treatments and procedures. The empty string is the special case where the sequence has length zero so there are no symbols in the string. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Is experiencing symptoms of COVID-19 and seeking a medical diagnosis. The service constantly aggregates exchange rates from the most reliable and trusted e-currency exchangers and presents them in the form of a well-structured and dynamically updated table. Send Submissions to CCPALPDPR REG-127770-07 room 5205 Internal Revenue Service PO.

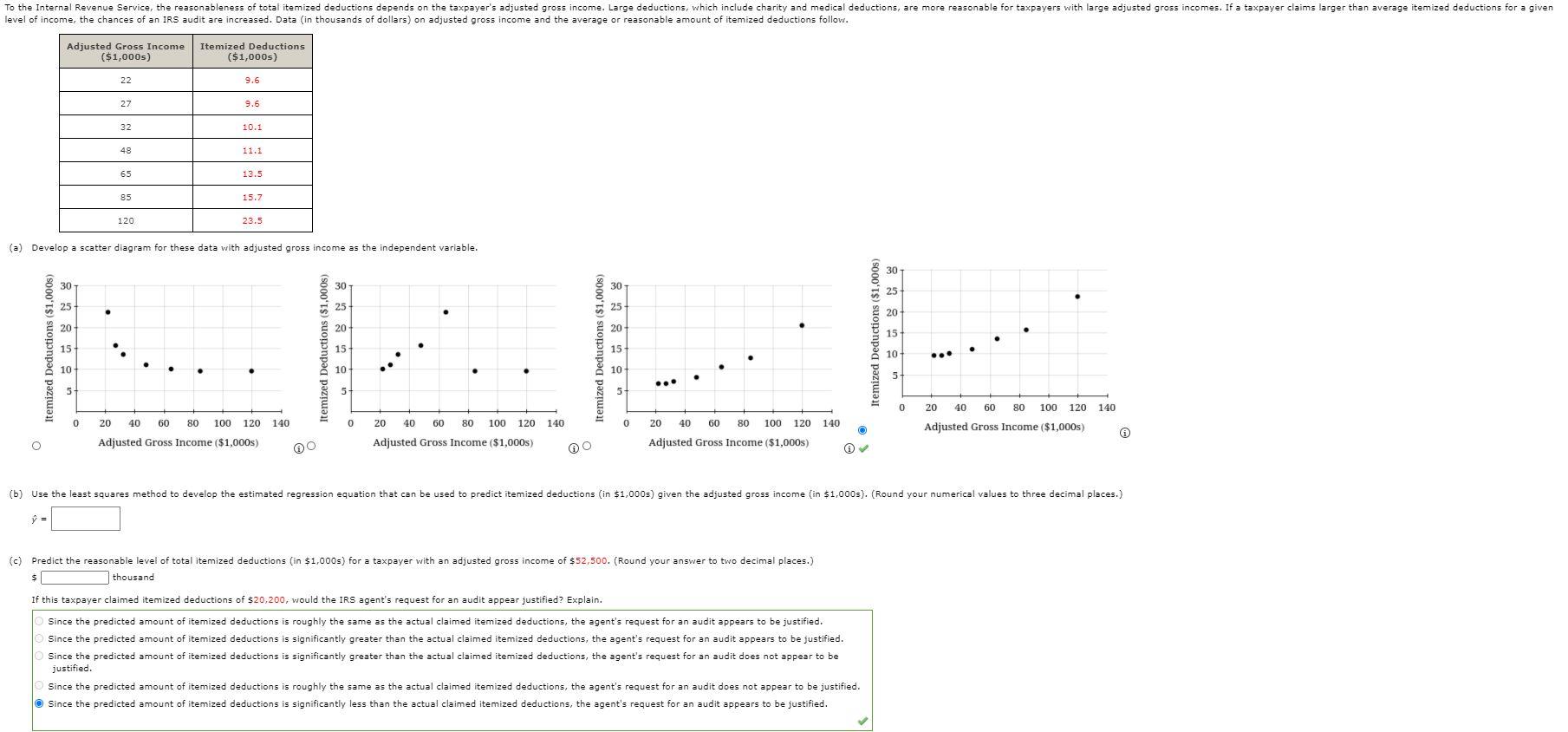

Medical and dental expenses some taxes certain interest expenses charitable contributions casualty and theft losses and certain other expenses may be itemized as deductions on Schedule A. NW IR-6526 Washington DC 20224. You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

The same process is used for most. Internal Revenue Service ATTN. NW IR-6526 Washington DC 20224.

NW IR-6526 Washington DC 20224. Federal taxes and administering the Internal Revenue Code the main body of the federal statutory tax lawIt is part of the Department of the Treasury and led by the Commissioner of Internal Revenue who is appointed to a five-year. The Internal Revenue Service is a proud partner with the National Center for Missing Exploited Children.

NW IR-6526 Washington DC 20224. Travel Management Section PO. Comments and suggestions.

Getting answers to your tax questions. 368 which provided guidance to tax return preparers regarding the format and content of consents to use and consents to disclose tax return information with respect to taxpayers filing a return in the Form 1040 series eg Form 1040NR Form 1040A or Form 1040EZ under regulations section. Internal Revenue Service Ogden UT 84201-0008.

Of medical equipment with a unique retail model that enables hospitals to acquire new and preowned equipment via revenue. Impulse Academy Best Education Center. TIN Matching Coordinator SCCPFCCSCDM Philadelphia PA 1910702 Content of QPCA application.

IPU 21U0984 issued 07-27-2021 and 21U0972 issued 07-23-2021 has been deleted from the IRM as not applicable for 2022 processing. You must use the US. Most payers follow the Medicare guidelines.

15 IRM 31135227 Exception - Revised ACA correspondence Action Code from 231 to 232.

Form W 2 Vs W 4 What S The Difference By Sagenext

Irs Courseware Link Learn Taxes

The 9 Steps Of Healthcare Revenue Cycle Management Explained

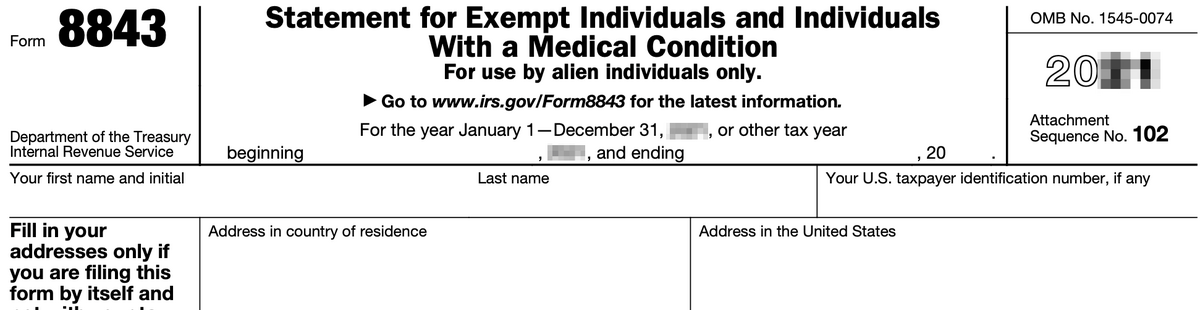

Irs Form 8843 Office Of International Students Scholars

Exploring The Fundamentals Of Medical Billing And Coding

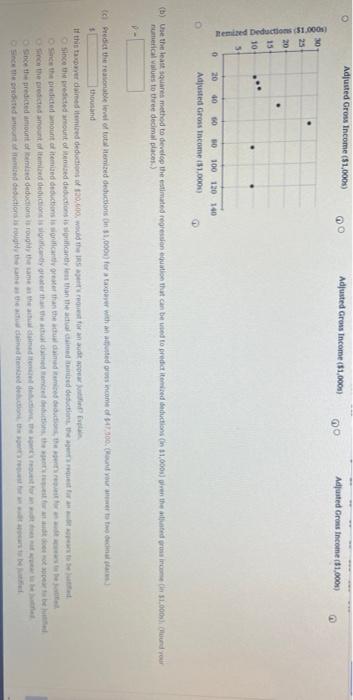

Solved Depasestion2652790 To The Internal Revenue Service Chegg Com

Internal Revenue Service Building Hi Res Stock Photography And Images Alamy

Medical Revenue Services Medical Billing Services

Azalea Revenue Cycle Management Fact Sheet Azalea Health

Solved To The Internal Revenue Service The Reasonableness Chegg Com

Irs Proposes Rules For Direct Primary Care Arrangements Hylant

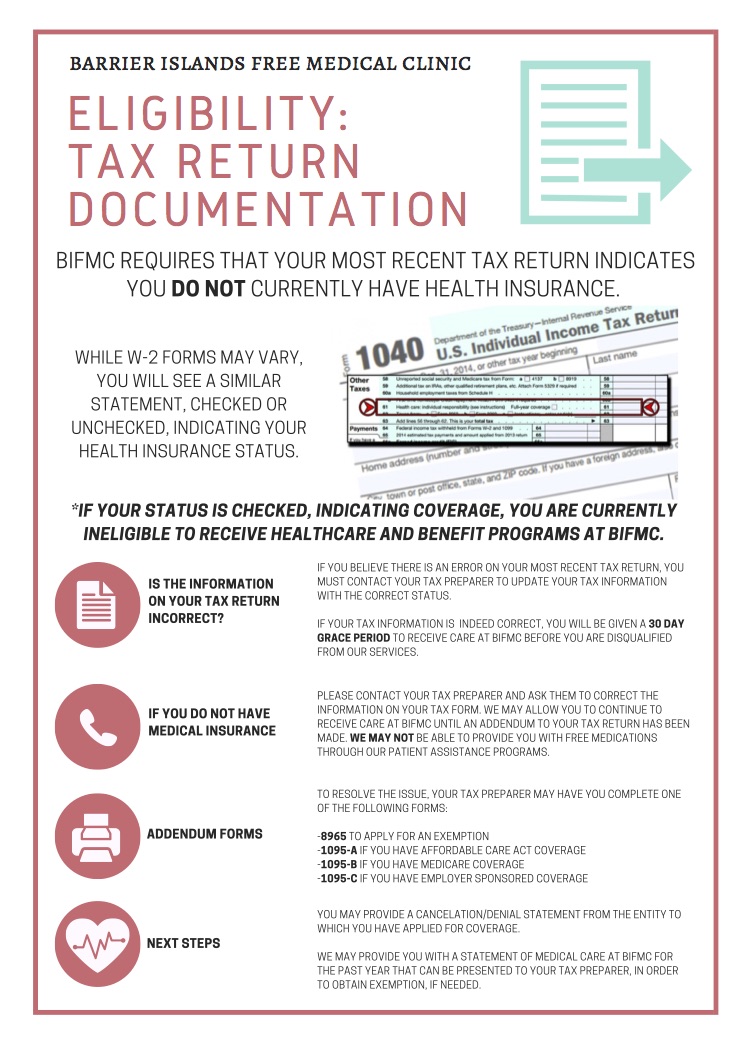

I Am Eligible For Free Health Care Barrier Islands Free Medical Clinic

What Is A Medical Revenue Service How Does It Work

Irs Makes Substantial Changes To 1099 Misc Form Williams Keepers Llc

The Comprehensive Revenue Cycle Flowchart Steps Enter

Irs Publication 502 Medical Expense What Can Be Deducted Tax Free Core Documents

Gop Fears About Irs Access To Medical Records Disputed Kaiser Health News

:max_bytes(150000):strip_icc()/tax-documents-to-the-irs-3973948-0d372f2897a34944abb220e99cca25ce.jpg)